##Set-Up

Super-admin needs to set up the tax system

- Set up your country / region as default tax zone

- Set up required tax categories

For Australia, we have one - GST

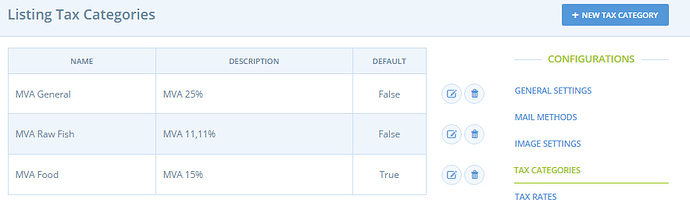

If you have different tax rates for different kind of products (for example, 20% as default tax rates, but reduced rate 15% for food products), then you have to create different tax categories, one per type of products, and select if you want which one you want to display by default [see image below].

- Then you can set up one or more tax rates within this tax category

Again, for Australia we only have one - 10%

You will have one tax rate per tax category for your default zone. If you are delivering to zones with a different tax rates, you can create other tax rates for your category and link them to the according zones.

This is set to ‘included in price’ for both GST and VAT, as the tax is included in the price of products rather than added on afterwards.

##Who charges tax?

Enterprises have a ‘Registered for sales tax’ / ‘Registered for GST’ flag in their enterprise profile under Business Details - that can be true or false. No tax will be charged unless the hub for an order is registered for sales tax.

##What is charged?

If Enterprise is ‘registered for sales tax’, then

- they can mark products as GST/VAT inclusive, which will then consider that they have 10% etc included in price.

- the shipping charge (ie. pickup or to the door delivery) may be inclusive of tax. The tax on shipping can be configured from the Tax Settings page.

- fees can be set to be inclusive of or exclusive of tax by putting them in a tax category on the Enterprise Fees page.

If Enterprise is not registered for sales tax, then

- no tax is recorded in orders from that enterprise, even when tax is configured for products, shipping or enterprise fees

How is tax on fees calculated? (a worked example)

- There is a cake that attracts 10% GST. It sells for $22, inclusive of $2 GST.

- Henry’s Hub charges a packing fee of 5% on all of their cakes. This packing fee includes 10% GST.

- The packing fee is calculated at 5% of $22 = $1.10.

- The packing fee is inclusive of $0.10 GST.

- Therefore, an order for the cake will cost $22 + $1.10 = $23.10, and will include $2 + $0.10 = $2.10 GST.

##How is this displayed to Customer?

The Shopfront will then show the tax inclusive prices, which are broken out purchase process as follows:

The full-page cart and the order confirmation page+email will show:

- The item prices, inclusive of GST

- [TODO] Each of the fees charged, marked as “(inc. GST)” when GST is included in it

- [TODO] Per order / admin & handling fees, marked as “(inc. GST)” when GST is included in it

- [TODO] The shipping charge, marked as “(inc. GST)”

- The total GST charged in the order

- The total price, inclusive of GST

[TODO] The checkout screen will show:

- The same things as the other screens, except the item prices and fees will be shown as subtotals instead of as an individual breakdown.

- NB. No tax details are currently shown on the checkout screen, since these values are more difficult to calculate due to the dynamically changing shipping method.

What happens when an existing enterprise registers for GST?

- A producer is registered for GST and is supplying a cake.

- The cake attracts GST, and its GST-inclusive price is $22.

- A hub that is not registered for GST is selling the cake.

- The hub sells the cake for $22 - there is no change to the price.

- The hub then registers for GST.

- The cake still sells for $22, but now $2 of that is charged to the customer as GST, and the hub keeps only $20 after tax.

- If the hub wishes to prevent this shortfall, they must increase the price of the cake to $24.20.

##Reports

- [TODO] The Customer Totals report will need a new column that includes the GST total - see git

- Reports may need to be adjusted to separate the fees out and see the tax for correct accounting, see here

- Sales tax report should now be correct, but could be much more readable, see git

Check

- easy enough to handle standard and reduced rate for UK VAT? This could be solved by having two categories, one for standard rate and one for reduced rate. Then products would be put in the appropriate tax category.