Please also refer to that discussion: Outstanding Tax Requirements (Jan 2016)

@lin_d_hop I think there is another issue here whish is not addressed.

Let’s say you have producers A, B, C who have entered their masterprice including VAT(or the hub has done that for their supplier as they manage their product catalog for them)

And let’s say you have producers D, E, F who have entered their master price not including VAT.

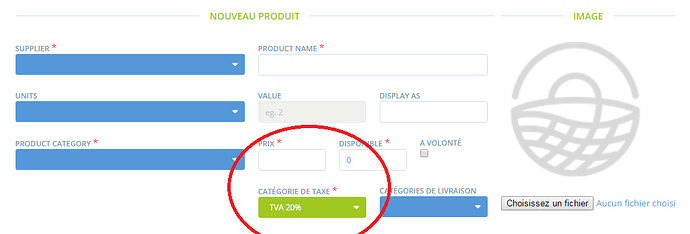

Today there is not way when you enter the masterprice of the poduct to know if you are supposed to enter the price with VAT or without. It is not clear at all, as the “included in price” box has been clicked on the Tax configuration panel for the whole instance.

A workaround as @oeoeaio suggested is to duplicate all the tax categories and precise that one is “including VAT” and the other “not including VAT” so the hub manage will precise that when he enters the masterprice by selecting the right tax category.

But to complicate the thing, if a BtoB hub wants to supply products from producers A, B, C, D, E, F, some masterprices include VAT and others don’t… How does it work if he wants to supply in his shops products without VAT (as in BtoB products are always displayed without VAT…)? It seems a bit confusing as some products already have the tax in masterprice… Can this work anyway? Isn’t it confusing for the BtoB hub to add to his shopfront a product with a price including VAT, without knowing the price he proposes to his customers?

My opinion on that is that** we should just display as a rule near the price box that masterprice should be entered excluding tax, and tax added by choosing the tax category which will apply on the master price. Then the option to show products with or without VAT should be at the order cycle configuration level.**

As hubs need to be able to cooperate, I think we need to choose a standard to enable that cooperation…

I know that means that it requires the hub maybe to calculate the price without VAT to enter this one…

Maybe another option would be that if the hub enter for a product a price including VAT, the masterprice is recalculated excluding VAT (so it does the job for the hub and avoid mistakes). But I think the standard should be that the masterprice doesn’t include VAT.

Another standard that I always explain to users is to enter the prices of the wholesale (when a farmer sells products directly in his shopfront AND through a hub, the hub will add the products to his order cycle and add his margin, he will probably get a wholesale price because he will buy big quantities…) so I explain the farmer that for his own shopfront, he can add an entreprise fee representing the cost of the distribution (the difference between the wholesale and the farmshop price) so the producs are displayed in his shopfront at the farmshop price.

Of course we want to leave the choice to hubs to decide for themselves, but as we create an interoperable platform (interoperability between producers & hubs here, not between instances) we need some basic standards on how we represent the products so that people an interoperate… For me those are the standard is: when entering a price, enter wholesale price without VAT.

This is my thought

So @Olivier and @RohanM I agree with what you said, and to be precise the desired behaviour for me is:

- The product masterprice should be entered without VAT, and the tax category of the product selected.

- If the producer is not in the VAT scheme, he will select a 0 VAT rate, so it means he doesn’t collect VAT, no issue here, the hubs buying the product don’t have to pay VAT, BUT they will pay the VAT on his margin (entreprise VAT) which is ok again

- If the producer is in the VAT scheme, he selects the good tax category.

- Ideally, the option to display VAT or not at shopfront is offered at the order cycle configuration level (as a hub can have BtoC and BtoC order cycles…)