Hi @oeoeaio ! I hope you manage to swim in the VAT sea  We were discussing yesterday with @Selmo about the French entity, and I was wondering about one thing.

We were discussing yesterday with @Selmo about the French entity, and I was wondering about one thing.

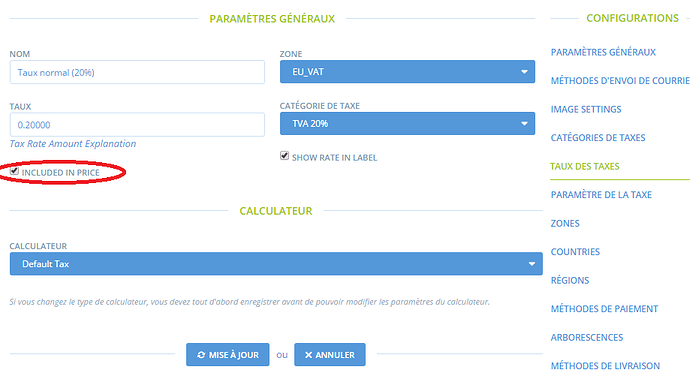

Today the choice of people filling in their master price / variant price including or not VAT is done for the whole instance, in the configuration panel (Tax rates)

But it seems the natural behaviour of hub managers change depending on the nature of the hub:

- for a CSA, or buying group, people are used to talk only including VAT, also with the producers, so they naturally tend to fill in the price with VAT included (they don’t even know the price without VAT!)

- for a BtoB hub, they will put the price without VAT as they always talk without VAT with their customer.

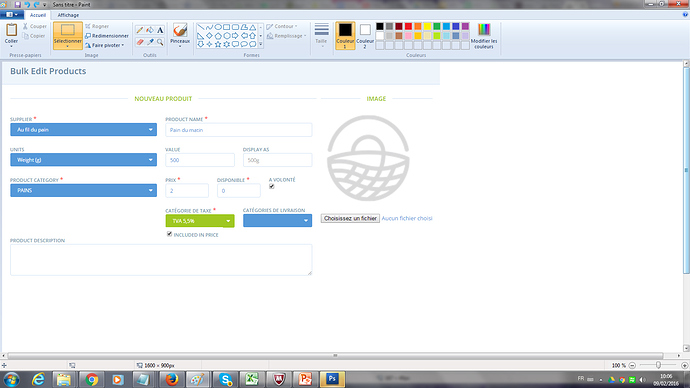

Is it possible not to have to configure that point for the whole instance, but when someone put a new product, put the price, says which tax category the product is, and check a box “VAT included in price”… that way the system would allow every user to do what is more convenient for them when they upload products, but then will leave the flexibility of hub managers to display prices with or without VAT in the shopfront, independant from the fact that the price have been filled in including VAT or not…

For example (I made a simulation on photoshop!):

I know I said first that it would be better to say that all prices are without VAT, but it doesn’t seem really adapted to the users’behaviours…

Let me know what you think.