VAT… interesting topic! So I have been through How does tax work - VAT and GST and https://guides.spreecommerce.com/user/configuring_taxes.html and I cannot seem to find the answer to my question.

Basically: do I have to add product with VAT included in the price or is there a way to enter prices excluding VAT and have it added on top when displaying to end customer?

I know it is possible to create a “Tax Rates” with “INCLUDED IN PRICE” flag to false which means the VAT is added on top but in that case the price displayed to end-user is without VAT and is only added when completing the order - not very transparent (leading to “I though I ordered for 100 and now it displays 115???”).

We receive most price list from suppliers VAT excluded so it would help to be able to input it this way.

Thanks!

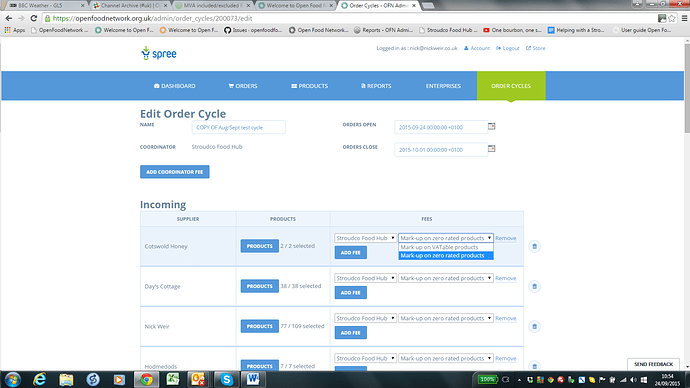

Stroudco charges VAT on some products. We enter prices excluding VAT and excluding our mark up and then have set up 2 different enterprise fees - one for zero-rated products and one for standard-rated products - see screenshot.

The price displayed to the shopper then includes VAT (if added) and our markupBut do you mean that you don’t pay VAT to your supplier? Even if a supplier does not show in his standard price list it is always expected that VAT should be paid on top.

Ok, but your trick works - thanks! But isn’t this more a workaround?

Some issues I see:

- Now the VTA is visible in the price breakdown as a fee, when it really is not a fee - it is just tax. Especially when it does not seem possible to add a custom “Fee Type”…

- The fact that a price had VAT or not included is specific to a product (or a supplier if all products follow the same model) so it does not sound the most practical to have to define it at the order cycle level…

- And basically counting VTA as a fee for some cases and not for others may add some difficulties to accounting later on

Any view on this, anyone? Our current workaround is to enter all prices with VTA included. We dont want it to appear as a fee which it is not.

Thanks for the support!

/Olivier

Hi @Olivier

The same issue has just been raised in the UK.

I think the main confusion is that ‘Included in Price’ actually does two things.

- It adjusts whether the tax is shown in all shop prices or if it is added at checkout.

- It indicates whether the master price should include tax or not.

We also use the same workaround as you and have the same issue that most supplier master prices are supplied without tax.

As so many of us are going to be using this workaround I suspect the solution will be to have configurable on the Product or enterprise level whether Master Price on product is inclusive or exclusive of tax.

Tax is a slippery beast so the less we fiddle with it the better. However the current functionality is no intuitive to anyone who has used other POS platforms.

@Olivier, @NickWeir, @oeoeaio, @RohanM, @MyriamBoure, @CynthiaReynolds Any thoughts?

Also ping @Oliver… I’m sure I missed others…

Hi @lin_d_hop,

Just to confirm that I have the understanding of the issue; The desired behaviour would be to enter prices in the back-end exclusive of tax, and then they would display with tax added on the shopfront (before the checkout is reached)?

Possible desired behavior is that:

- The product price should be without VAT

- For companies not subject to VAT, no VAT is added at shopfront or check-out

- For companies subject to VAT, it is configurable (entreprise wise or maybe even per order cycle) whether the shopfront show price VAT inclusive or if is only added at checkout

@MyriamBoure @CynthiaReynolds @LucieB please correct if I am missing anything

@Olivier - as a number of users will now be inputting all their products’ master price including tax we need to have the option for the product master price to be inclusive or exclusive of tax.

@RohanM - Yes that is correct. Essentially users would like OFN to do all tax calculations so master price can be entered without tax, which is how VAT registered users will receive the price on their invoice.

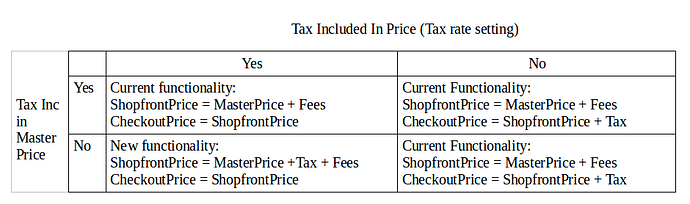

From this point (in which VAT registered uk users are entering master prices including VAT) the best solution I see is to add a field to the product - Tax Included in Master Price - to indicated whether or not the master price is inclusive of tax.

This will then have the following relationship with Tax Included In Price:

I imagine there will be lots of fiddly nonsense testing this and ensuring reports are working correctly. Therefore I imagine a pretty big piece of work involved.

The UK can workaround for as long as we need to if this is the implementation, meaning that it is low priority.

@Olivier, @CynthiaReynolds, @LucieB, @MyriamBoure - How important would this be to you? We could explore splitting the cost of the development?

@oeoeaio, can you comment on how this fits with Spree’s more recent rework of tax?

Please also refer to that discussion: Outstanding Tax Requirements (Jan 2016)

@lin_d_hop I think there is another issue here whish is not addressed.

Let’s say you have producers A, B, C who have entered their masterprice including VAT(or the hub has done that for their supplier as they manage their product catalog for them)

And let’s say you have producers D, E, F who have entered their master price not including VAT.

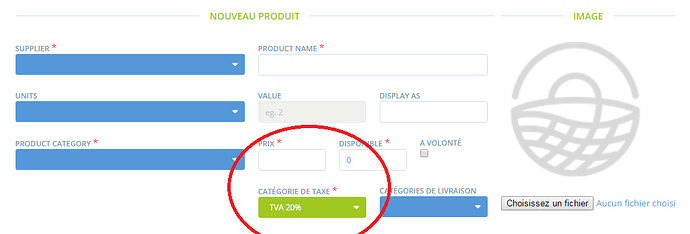

Today there is not way when you enter the masterprice of the poduct to know if you are supposed to enter the price with VAT or without. It is not clear at all, as the “included in price” box has been clicked on the Tax configuration panel for the whole instance.

A workaround as @oeoeaio suggested is to duplicate all the tax categories and precise that one is “including VAT” and the other “not including VAT” so the hub manage will precise that when he enters the masterprice by selecting the right tax category.

But to complicate the thing, if a BtoB hub wants to supply products from producers A, B, C, D, E, F, some masterprices include VAT and others don’t… How does it work if he wants to supply in his shops products without VAT (as in BtoB products are always displayed without VAT…)? It seems a bit confusing as some products already have the tax in masterprice… Can this work anyway? Isn’t it confusing for the BtoB hub to add to his shopfront a product with a price including VAT, without knowing the price he proposes to his customers?

My opinion on that is that** we should just display as a rule near the price box that masterprice should be entered excluding tax, and tax added by choosing the tax category which will apply on the master price. Then the option to show products with or without VAT should be at the order cycle configuration level.**

As hubs need to be able to cooperate, I think we need to choose a standard to enable that cooperation…

I know that means that it requires the hub maybe to calculate the price without VAT to enter this one…

Maybe another option would be that if the hub enter for a product a price including VAT, the masterprice is recalculated excluding VAT (so it does the job for the hub and avoid mistakes). But I think the standard should be that the masterprice doesn’t include VAT.

Another standard that I always explain to users is to enter the prices of the wholesale (when a farmer sells products directly in his shopfront AND through a hub, the hub will add the products to his order cycle and add his margin, he will probably get a wholesale price because he will buy big quantities…) so I explain the farmer that for his own shopfront, he can add an entreprise fee representing the cost of the distribution (the difference between the wholesale and the farmshop price) so the producs are displayed in his shopfront at the farmshop price.

Of course we want to leave the choice to hubs to decide for themselves, but as we create an interoperable platform (interoperability between producers & hubs here, not between instances) we need some basic standards on how we represent the products so that people an interoperate… For me those are the standard is: when entering a price, enter wholesale price without VAT.

This is my thought

So @Olivier and @RohanM I agree with what you said, and to be precise the desired behaviour for me is:

- The product masterprice should be entered without VAT, and the tax category of the product selected.

- If the producer is not in the VAT scheme, he will select a 0 VAT rate, so it means he doesn’t collect VAT, no issue here, the hubs buying the product don’t have to pay VAT, BUT they will pay the VAT on his margin (entreprise VAT) which is ok again

- If the producer is in the VAT scheme, he selects the good tax category.

- Ideally, the option to display VAT or not at shopfront is offered at the order cycle configuration level (as a hub can have BtoC and BtoC order cycles…)