All information has been taken from - https://www.ato.gov.au/Business/GST/Issuing-tax-invoices/

This doc shows how tax invoices should be laid out - https://www.ato.gov.au/workarea/DownloadAsset.aspx?id=6010

These 6 things need to be on all tax invoices:

- that the document is intended to be a tax invoice (the words TAX INVOICE)

- the seller’s identity (Name of Selling Enterprise)

- the seller’s Australian business number (ABN)

- the date the invoice was issued

- a brief description of the items sold, including the quantity (if applicable).

-

Price and GST - need to show how much GST each item carries.

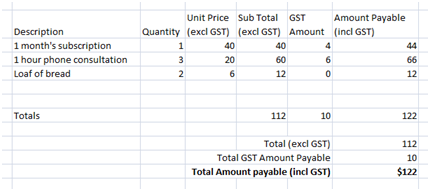

It seems to me that the best way to do the price would be like this:

- You need to clearly show the extent to which each sale on the invoice includes tax. An acceptable way to do this is have the GST amount column with a number or zero in it. This would meet the requirements if it was all taxable items, no taxable items, or a mix of both.

Our current order confirmation is not too far from this, but as you can see doesn’t meet the requirement of showing which items incurred GST.

Where invoice is for a sale of $1000 or more:

- The Purchasers Identity. Can be its name, or ABN.

Where no items are taxable:

- Instead of ‘Tax Invoice’ it should say ‘Invoice’ somewhere.

- The statement ‘No GST has been charged’- or if ‘Total GST amount payable = $0’ this might also be adequate.

Optional:

- Invoice number

- Contact details

- Payment details