Thanks for summing up the conversation @oeoeaio![]()

Here there is something I don’t understand (I read the technical post also but not sure I understand either :-o)… because from what I had understood, in Australia the master price of the products doesn’t include tax, does it? See here Kirsten’s comment on the 7th December: “you don’t put the prices in with vat, you choose whether the product should have tax attached or not, then it will be added or not”

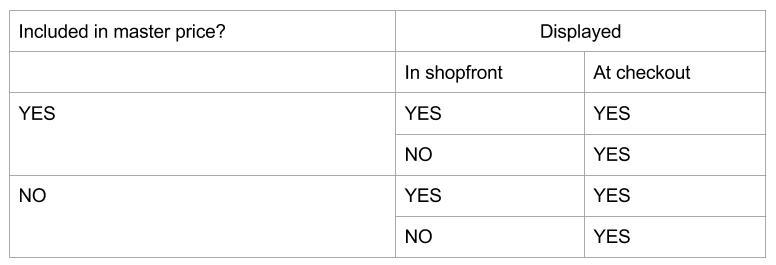

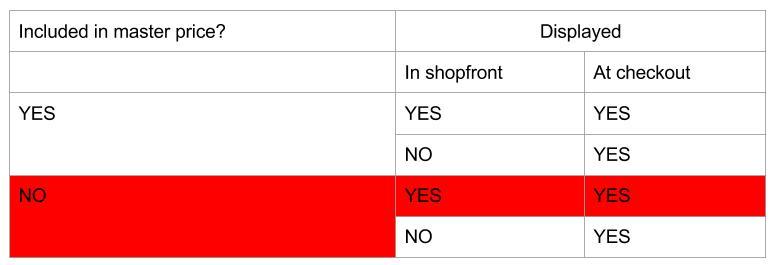

So when I read that I just want to be sure I understand well and we are on the same page, so I made a quick table:

I think it’s a good practice to put the prices in master price always without VAT, so that then if the product is used by another hub, there is no misunderstanding, and especially for hubs that buy to producers in another country, it’s important that all the master prices are without VAT.

So definitely, Norway, and France, want to write the master price without VAT and select in the product page the VAT rate that should apply to the product.

So I if (included_in_price=false) means exactly what I said, then that’s our preferred option, so if that’s the preferred option for Australia then we are on the same page ![]()

BUT I think the main difference is that we want the price displayed in the shopfront to include the VAT, which doesn’t seem possible today. That is why actually @NickWeir uses an entreprise fee called “VAT” to be able to include the VAT in the shopfront view (but I’m not sure that’s really what we should do, because it appears as “admin fee” for the customer…)

So of course, ideally we would like to give the choice to the order cycle coordinator to choose, for the order cycle, if he wants to display the VAT in shopfront or at checkout (so that a hub working with business and customers can adapt his shopfront to his customers type). BUT as you say, this is just nice to have for the moment.

What we need is (I will reformulate as I don’t understand the “forward calculated tax”)

1- HIGH PRIORITY [feature] to be able to display the price in the shopfront including the VAT.

Ex: banana cost 10, 10% VAT, 20% admin fee with 10% VAT on the fees, price shown is 13,2 in shopfront (10+1+2+0.2)

NICE TO HAVE [feature] Allow the order cycle coordinator to choose if the VAT is displayed in the shopfront or only at checkout

2- How is that shown in price breakdown? HIGH PRIORITY [feature] should be one of the 2 options:

- Each line is shown including VAT, without precising the VAT in the price breakdown > If easier we can go for this option. Ex: price breakdown shows item=11, fee=2.2

- BUT it will definitely be more transparent if in the price breakdown, you would have one line for the VAT, because actually the item line for me show how much get the farmer (and the VAT is not something the farmer get!) Ex: price breakdown shows item=10, fee=2, VAT=1.2

What do you think @NickWeir?

I’m actually pretty fine with both options, maybe too much details make things hard to read too…

I think we should just choose together one of the two options, as both are consistent, so what is the easiest and more easy to grab while remaining transparent for the customer? Ping @Olivier and @CynthiaReynolds on that point

3- How is that shown in the basket page / checkout page? [feature] show a breakdown of aggregated tax for different tax rates

Yes, that’s it, but from what I see it might already be done in the checkout page (we just need to check when the bug on fees tax is solved if the tax on fees are added in the aggregation process). Actually I checked back and the legal obligation is only on the invoice, so maybe we should treat that point in a seperate discussion about Norwegian invoices, and take that out of this whishlist. But we will need that info to be displayed in the invoice so it’s good to have that in mind so that the info can be taken somewhere ![]()

Ouf! I hope all y comments are clear ![]()

And I send you lots of energy @oeoeaio, working on tax is not that fun I guess ![]()