Continuing the discussion from: Outstanding Tax Requirements (Jan 2016)

I made a simulation in the French staging server, I believe French VAT model is the complex ones (similar to other EU like Norway as well I guess) so the case I mention here need our attention as it really implies some process thoughts.

Imagine the case:

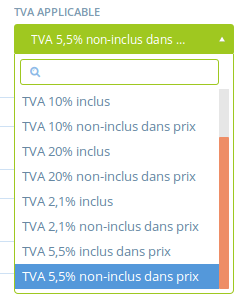

- producer A is a wholesaler used to sell to shops, so he talks without VAT, when he negotiates with buyers, the prices are always discussed without VAT (in a BtoB environment it’s always the case). So his product catalog is set up without VAT. (I sat up various rates including and not including VAT as proposed by @oeoeaio here) So here the producer has chosen “VAT 5,5% not included in price”

- producer B is used to sell BtoC, so he talks in prices including VAT. In his product catalog, he puts the prices including VAT and choose, let’s say “VAT 10% included in price”

Foodhub (shop) C sell products from the producer A and from producer B.

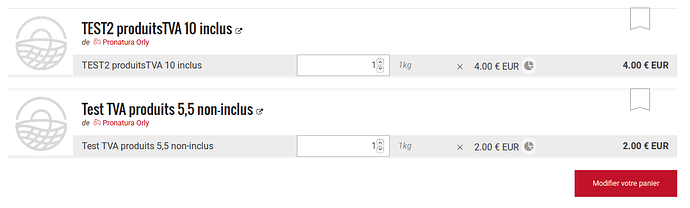

Here in the simulation I used two products of the same producer, but it doesn’t matter.

-Product A is set up at 2€ and doesn’t include in price the 5,5% VAT. So VAT to add up is 0,11€.

-Product B is set up at 4€ and includes in price the 10% VAT. So price before tax * 1,1 = 4, so price before tax = 3,64 and VAT = 0,36€.

No entreprise fee for the simulation.

→ First this shouldn’t possibly happen, in the process to set up an OC the system should ask you if you want the prices to include VAT or not in shopfront, and if yes, add the VAT to the price display for the product which has a VAT rate “not included in price”, if no, withdraw the VAT for the product with a rate “included in price”. You cannot in one shop have products with and without VAT, it’s not possible for the shopper to know then what he buys at which price! So this is an absurdity that shouldn’t be possible. And as there is no convention about if the product catalog should be uploaded with prices including or not including VAT, this case unfortunately will happen as soon as we have enterprise submitted to VAT trading (not the case yet but hopefully will come soon! Ping @CynthiaReynolds as that might be a problem for Norway as well).

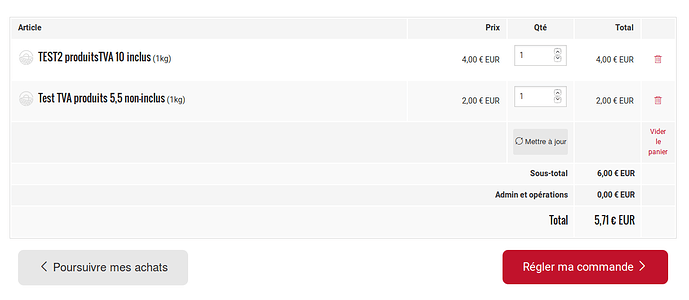

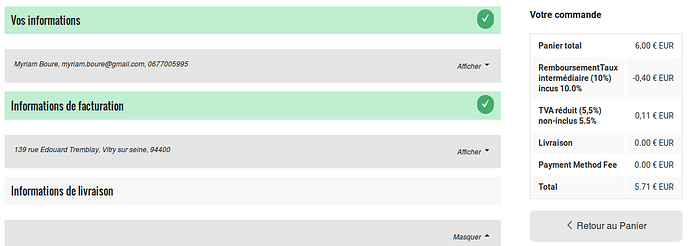

→ Second if I proceed to checkout, something very strange happen:

1- the line “(includes tax)” at the end of the basked doesn’t appear (contrary to what @sstead tested here) and the total price is lower than the one displayed (

2- In the next page, checkout we see the explanation, the system has withdrawn the tax from product B, and added the tax for product A. 6 - 0,36 + 0,11

3- As you see there is a mistake in the way the tax is calculated from the product where VAT is “included in price” (0,40 instead of 0,36)

I guess what I propose here would solve this problem:

Ping @Kirsten, I’ll go back to the other thread and propose to open a co-budget to fund this, but need quotation.